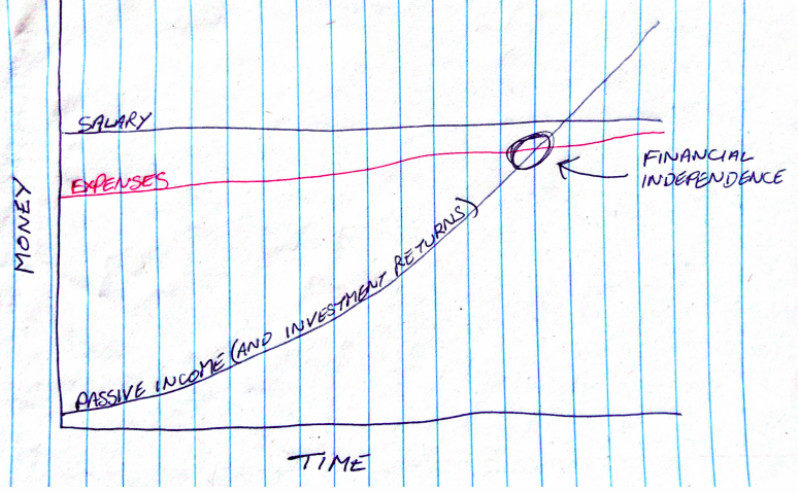

Financial Freedom means only one thing: more money coming in than going out without you having to work for it.

MANY PEOPLE SAY they want to be financially free without looking too closely at what that means. Many want to be rich thinking that this is the same thing when it’s really not.

Want your bucket to be full? Either pour the income in faster, plug the holes in your expenses or combine the two. That’s all there is to it. You don’t necessarily have to be rich to be financially free.

“The man earning $500 a month with expenses of $450 is in a better situation than the man earning $10,000 and expenses of $10,500 a month.”

More important than Financial Independence itself, is the reason you want it. You need to have a ‘why,’ both to drive you forward and for avoiding the ‘What now?’ emptiness when you achieve it.

For What Purpose?

The inquiry into why your really want Financial Freedom is an important one. If you find it’s because you crave security for your family it will drive you differently to whether you want to buy an old yacht and sail around the world. Fear and inspiration are the two drivers. Fear will lose its power the further away you get from it. Inspiration gains power the closer you get to it. You need an inspired reason why you want it or Financial Freedom will be almost impossible for you to achieve.

Imagine you are in a field and a Bull starts to chase you. The closer he gets, the greater the fear, the faster you run. When you’ve gained some distance you start to relax as the feeling of danger subsides. This is the fear-driven example. You might build up a good level of income but eventually feel so comfortable that you ease off the pressure for earning your extra income and even start spending more, building on your monthly expenses.

Imagine you are in a field and a Bull starts to chase you. The closer he gets, the greater the fear, the faster you run. When you’ve gained some distance you start to relax as the feeling of danger subsides. This is the fear-driven example. You might build up a good level of income but eventually feel so comfortable that you ease off the pressure for earning your extra income and even start spending more, building on your monthly expenses.

Imagine you are running for a train (before the era of automatic doors). You are so close you dig deep to sprint the last couple of metres. This is the inspired dream. The closer you get to it, the more achievable it appears and then the dream is easily reached.

Imagine you are running for a train (before the era of automatic doors). You are so close you dig deep to sprint the last couple of metres. This is the inspired dream. The closer you get to it, the more achievable it appears and then the dream is easily reached.

The Family Man, Craving Security. (The plan)

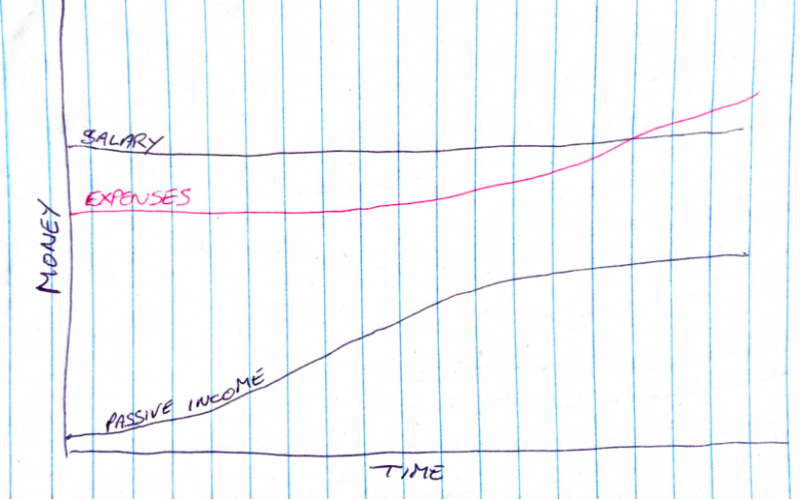

Remember that the total income above is the total of the Salary and the Passive Income and that level will be the total of your salary plus expenses before you achieve Financial Freedom. Consequently, the closer you get, the more secure you feel and the weaker the driver will be to get you the rest of the was. The passive income curve will likely flatten out and the expenses line will start to curve upwards. It will take a lot of motivation and discipline to make it all the way. Even when you get there you will have the dilemma of losing all your disposable income when quitting your job… your perspective always changes along the way.

The Family Man, Craving Security. (Likely outcome)

Remember, Salary plus Passive Income is the TOTAL income so income level is still above expenses. But since the inspiration and motivation have waned, Financial Independence has got away from him. This guy has more money than before and enjoying the fruits but the goal of Financial Freedom is still a distant dream. The motivation is likely only to return when there is a threat of job loss or other financial impact.

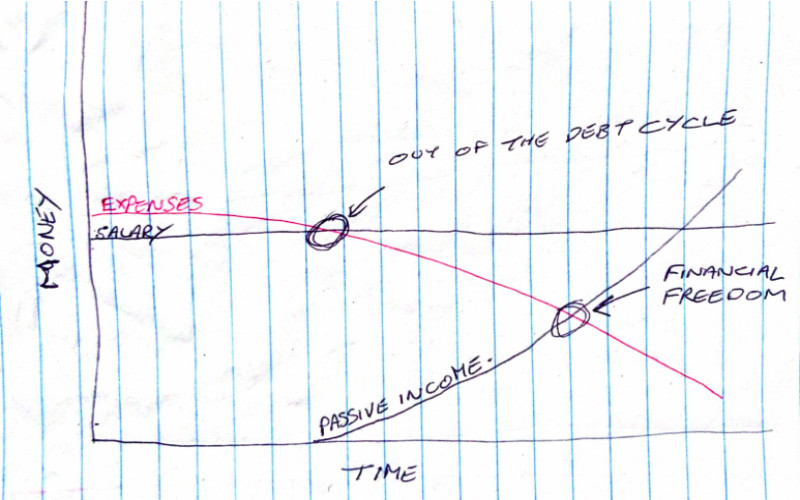

The Downsizer, Looking For A Simpler Life

There’s a lot to be said for minimalism and decluttering. It’s cheap for starters and it deals with addiction to materialism. If you are able to let go of attachments then you can dramatically cut your expenses. If you sell your house and go WWOOFing or house-sitting then you have almost no expenses. Normally, more possible for single or divorced people with no family but it’s not entirely impossible for whole families to go this route.

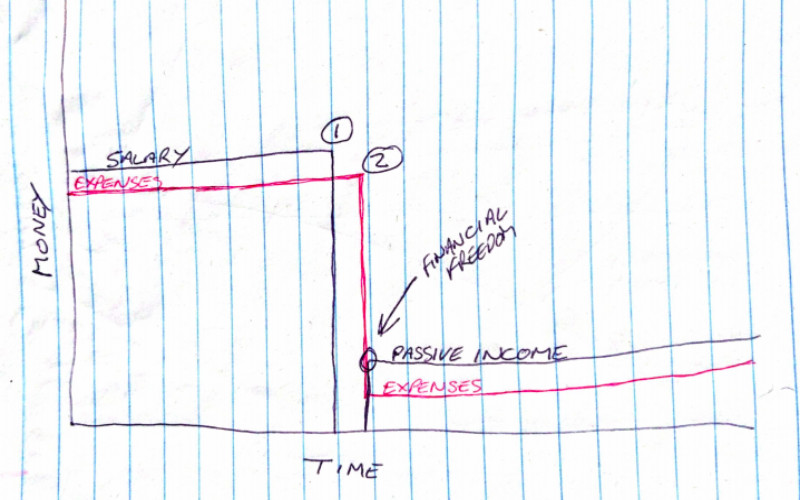

The Man With A Dream To Travel The World.

…and you don’t have to sell your house.

Key: 1. Job loss 2. Rent out your house 3. Travel the world

Either laid off or quit your job? Letting out your house can cover your expenses or even bring you a sustainable income. The bonus here is that you both generate an income and cut your expenses in one fell swoop since your tenant will be picking up the tab on utilities etc. If the expenses level lands below your income level, well, there you are. You can either generate more income or take off working your way around the world.

Of course, technically you render yourself homeless – or as I prefer to call it – Nomadic. Not so much of an issue if you offer your services house-sitting or on Workaway, Helpx, WWOOF, Crewbay, etc. With your basic needs met, you have the opportunity to build a portable income if, if you want to expand your options later.

So, I hope you can see that financial freedom isn’t about wealth level. Without an income, savings of $1m will eventually drain away. Whereas, a small income of $500 a month will keep you going forever if your expenses remain below that. It’s a case of plugging the holes in your spending to keep the flow positive while you’re tending to the source…

If you are ultimately looking for happiness then you’re better off searching for that directly. And you are more likely to discover that by looking at ‘WHY’ you want Financial Independence than looking for Financial Independence itself.

Financial Independence is a tool for living, it is not the answer to life. just as a hammer is a tool for knocking in nails. You don’t really want the hammer, you just want your wooden joints to hold together…

Recent Comments